Salam,

Last Friday, we saw volatile movement in the currency market after the announcement of Non-farm Payroll (NFP). The data was actually better than analyst estimated. -247k against -320k. Normally what we would expected is USD would take a hit and other currencies benefited due to risk appetite sentiment. And that’s what happened briefly, Cable, Fibre all went up by 60-100pips, but before u knew it, the pairs went down crashing by more than 100-200pips. Luckily, I didn’t trade last Friday because I don’t like the volatility caused by NFP.

Could it be a sign that positive US fundamental data now would trigger a dollar rally instead of further risk appetite? This is because US is expected to recover 1st from the current economic turmoil than UK, Japan and the Euro Zone (which will be confirmed with this week’s GDP numbers). But such expectation is too early to tell and better yet, difficult to muster, as USD is considered as the world’s reserve currency and would be hard to shake off its safe haven currency tag.

Looking ahead to this week, here’s my fundamental analysis based on my favorite pairs:

Fundamental Analysis

Cable – The decision by BoE to increase Quantitative Easing further by GBP50bil to GBP175bil caused a sharp fall in the pair last week. This just further proves that the UK economy is recovering slower than the US.

Recent UK economic data has broadly shown relative improvement in domestic activity and said trend will be put to the test by upcoming Jobless Claims results. Consensus forecasts call for a 28.0k increase in Jobless insurance claims and a marginal increase to the national jobless rate at 4.9 percent. The result would represent the worst unemployment since 1997, but as recent market reaction to US Nonfarm Payrolls data clearly shows, financial markets are mostly interested in the rate of deterioration.

Short-term Cable momentum points to further losses, but it will be important to monitor financial market follow-through and key UK and US economic event risk.

Fibre – Sharp sell-off on Friday from macro perspective, shows that US is more bullish with their market and interest rate increment may be just down the line sooner rather than later. This is a sharp contrast to the neutral tone from ECB’s announcement last week.

Fibre could continue to fell this week if the 2Q GDP fell more than expected. It’s forecasted to show a 0.5% decline in 2Q compared to -2.5% in 1Q.

Aussie – Last week, the pair ended higher than previous week, helped by a bullish tone set by RBA, boosting growth forecasts and pointing an improved economic activity. They indicated that current rate is suffice to boost the economy and even said that they might increase rate later.

Currently, commitment of traders on the pair is at the extreme bullish. It’s hard to say whether the top has been reached but any negative data coming out this week could potentially see some corrections.

Kiwi – I am adding kiwi (NZD/USD) for this week’s analysis as I noticed that there’s some potential trading for this week based on technical. On the fundamental side, with stock market could potentially correct this week, we might see some unwind in the risk appetite for this pair.

Futhermore, retail sales will be announced on Thursday and it is expected to decline to -0.3% m/m compared to the previous mth’s 0.8% increase. If the data came out as expected, it shows that consumer spending which is a reflection of the overall economic activity, is still weak and does not bodes well for the pair.

Technical Analysis

Cable – Looking at the daily chart, Cable has almost reached the Upward trend line (UTL) for its support. At this level I am not looking to place any trade after considering last week’s huge swings, daily average movement now has surge to 214pips and there is no worthy risk/reward potential to take.

– Similarly, this pair has also reached it support at the UTL, which is also within an upward channel. Again, at this level, I am not taking any trade on this pair. However if it does break through the support level, I could possibly reconsider taking a short position.

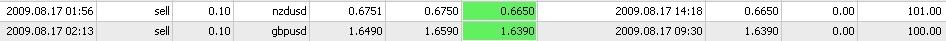

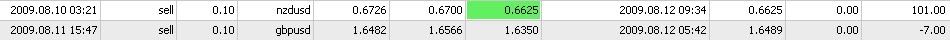

Aussie – The pair could potentially have reached a top, and possibly completing a wave 5 of Elliot Wave, which in theory, this would follow with correction wave. I could take a calculated risk and place a sell trade at current price, with a target pips of around 100-150pips for a risk/reward ratio of 1:1.2 (23.6 fib level) or 1.5 (38.2 fib level).

Kiwi – The last candlestick on Daily TF is forming a

shooting star. This is a sign of reversal. While in terms of Elliot Wave, we could be seeing the starting of a consolidation wave (a) – refer to chart. If these analysis holds true, we could see correction in this pair. I would take a sell trade on this pair, with a SL of 50-60 pips and a minimum of 100pips profit target, until it reached the UTL.

Read more...