Salam friends,

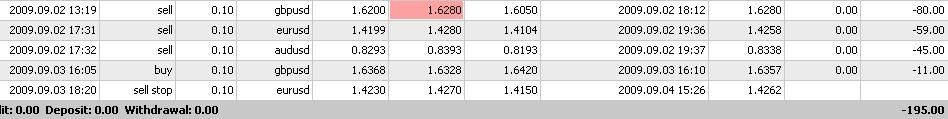

Last week was something for me to forget. But it is also for me to learn and correct my mistake. Let’s hope this week I can recover the losses from last week. Must continue to be disciplined and maintain my MM.

Okay, for the week ahead we could see potential significant breakout of major pairs as liquidity is expected to return after a range-bound summer period.

There are important news and data this week that could chart the movement and potential breakouts. To start with, there’ll be 3 rate announcement this week; RBNZ on Wed (9/9), BoE and BoC (Canada) on Thu (10/9).

It seems that it is almost certain that they’ll all maintain their current int. rates. However, the market-moving news would be coming from their policy statement. If their statement sounded bearish just like BoE did last month when they announce additional quantitative easing, then the pair could take a plunge.

Fundamental Analysis

Cable - Neutral

GBP still holding strong against the USD. What is surprising is that the economy is clearly far worst than other developed countries. Data has confirmed a deepening recession, policy groups have projected a significant lag in its recovery relative to its peers and ballooning asset purchases by the central bank means rate hikes are the furthest thing from their mind.

The only reason can only be risk appetite. The pair can possibly break 1.66 level even when their current economy is at the current state. However, to me, this upward movement is seriously in need of new reason to support it. Perhaps further stock market rally and investors’ improving risk appetite.

Fibre - Neutral

Although early of the last week saw EUR weakened against USD, towards the end it recovered as investors seems not ready to break from the trading ranges.

Should an equity market correction occur this month (which many economists had argued based on the ‘September Effect’), EUR could see some pullback but this scenario still remains an IF.

This week’s data should not be that market moving. German’s IP is expected to post 1.6% rise vs -0.1% last mth. CPI, meanwhile is expected to be flat m/m.

Aussie – Neutral

AUD were the clear winner among other majors against the USD last week. The pair went up by 1% last week alone.

The RBA held the benchmark interest rate at the 49-year low of 3.00% for the fifth consecutive month in September, and the central bank is widely anticipated to hold a neutral policy stance throughout the second-half of the year as the board forecasts economic activity to expand at an annual rate of 0.5% this year.

Yet, they could possibly raised the interest rates as early as October this year according to data provided by Credit Suisse.

Data for this week however could bring volatility to the market. Labor market expected to weakened further to 5.9% from 5.8% in July.On the other hand, retail spending is forecasted to rise 0.5% in July as the government commits more than AUD20bil in public projects to stimulate domestic demands.

Kiwi – Neutral

Key to the movement of this pair is the movement of the stock market especially the S&P 500 (SPX). Earlier last week we saw the pair dropped sharply when SPX plunged. However, the move shortlived and kiwi is now back to where it was at the start of last week.

Apart from the rate announcement by RBNZ this week, SPX’s movement should be watched closely to determine which trade to place for this pair.

Technical Analysis

Cable

Ermm this pair is interesting la..economy is not that nice but still looking at the technical, we could see it has already break the downward trend line (red) and potentially reached 1.66 levels.

My indicators are also showing that this pair is at the oversold level. Hence this represent a good setup for buy trade.

FibreCurrently the price is within an ascending triangle. Fibre could possibly heads further north should it break the resistance line (red).

Indicators are still at the mid range, meaning that the upward movement still have some legs.

AussieOn Friday, it shoot up like a rocket after beating the resistance 0.8459 which is the 61.8 Fibo level between 0.9850 and 0.6200.

However, this sharp movement to the north means that RSI for longer TFs such as 1H,4H and daily are all at the overbought level. Hence to enter buy trades at current level would not be a wise decision coupled with uncertainty on the movement of the stock market.

Waiting for some pullback before entering buy trade on this pair is safer should the trend still intact.

KiwiIt is approaching the 61.8 fibo level (refer to chart) which is about 70pips away. After that we could possibly see retracement as indicators giving an overbought signal. Current setups looks more likely that the price will went up instead of going down.

Read more...